I’m surrounded by millennials—my four oldest kids (and their partners) were all born between 1982 and 2000. I’ve also done a bit of research, so I have a lot of opinions. I’m good at having opinions. Just ask my kids.

Okay, so here (in my opinion) is why you’re having financial problems—and how I think you can fix those problems:

*Everyone (and by everyone, I mean my generation—the baby boomers) pushed you to go to college or university. And you did—millennials are now the most educated generation in history. Sadly, the cost of post-secondary education has quadrupled in the last 30 years, so the average millennial now graduates with $33,000 in student loans (and 66% of you have other debts—like bank loans and credit cards—that you’re trying to pay off, as well).

*Thanks to that art history degree, you have a great job, now, right? No? Well, you’re not alone. Minimum wage jobs, part-time jobs, one-year contracts…today’s sluggish economy means even Ph.D.s can be found stocking shelves and cleaning out deep fryers.

*Want to buy a house and raise a family? At least 90% of millennials do, but low-paying jobs, your current debt load and the banks’ tighter lending standards mean that 48% of you are living paycheck to paycheck and just can’t see a way to make that dream a reality.

*Want someone to talk to about your problems? Good luck with that. Since 1985, the number of young adults with no one to confide in face-to-face has tripled. Despite lots of social media contacts, millennials have fewer real friends than earlier generations did.

To sum up: You’ve got massive debt, no job security, can’t fathom how you’ll ever buy a house or take time off to raise kids, you’re feeling isolated, and my generation is bashing you for the mess they claim you’ve created. And they’re making fun of your avocado toast, which is actually quite tasty.

Sorry. I know—sometimes we’re assholes.

A quick word about your critics:

The average baby boomer has $107,000 in debt, and is carrying three times more credit card debt than you are. Nearly 33% of baby boomers have no money saved for their retirement, plus they’re still paying off mortgages. Keep in mind that these people have already burned through half a century of their prime earning years. They’re pretty hard on you, but they’ve done a crap job of managing their own finances.

You’ve heard the phrase “People who live in glass houses shouldn’t throw stones?” Nuff said.

The good news:

If I had been handed the economic mess that you’re facing, I’d throw myself on the floor and have a tantrum because, well, the world isn’t fair and I’m a drama queen. Not you:

*You’re budgeting. At least 34% of millennials already have a written financial plan, and 57% of you review and update those plans annually (only 27% of boomers can say the same thing).

*You’re adapting. The average new car costs $30,000 and sits in a parking spot for 23 hours every day. So millennials are buying used cars—or no car at all. They’re walking, biking, bussing, and getting into car-share programs like Zipcar.

*You’re sharing. Speaking of Zipcar, millennials are the reason the whole “sharing economy” is gaining such momentum—you’re using public bike-sharing systems, sharing accommodation through sites like Airbnb, and sharing clothing by hitting thrift shops or using websites like thredUP.

*You’re penny pinching. At least 60% of you skip name brands and grab the generics, instead—and 94% of you save money by using coupons.

So, what else can you do?

- You’re already paying off your debt—pay more

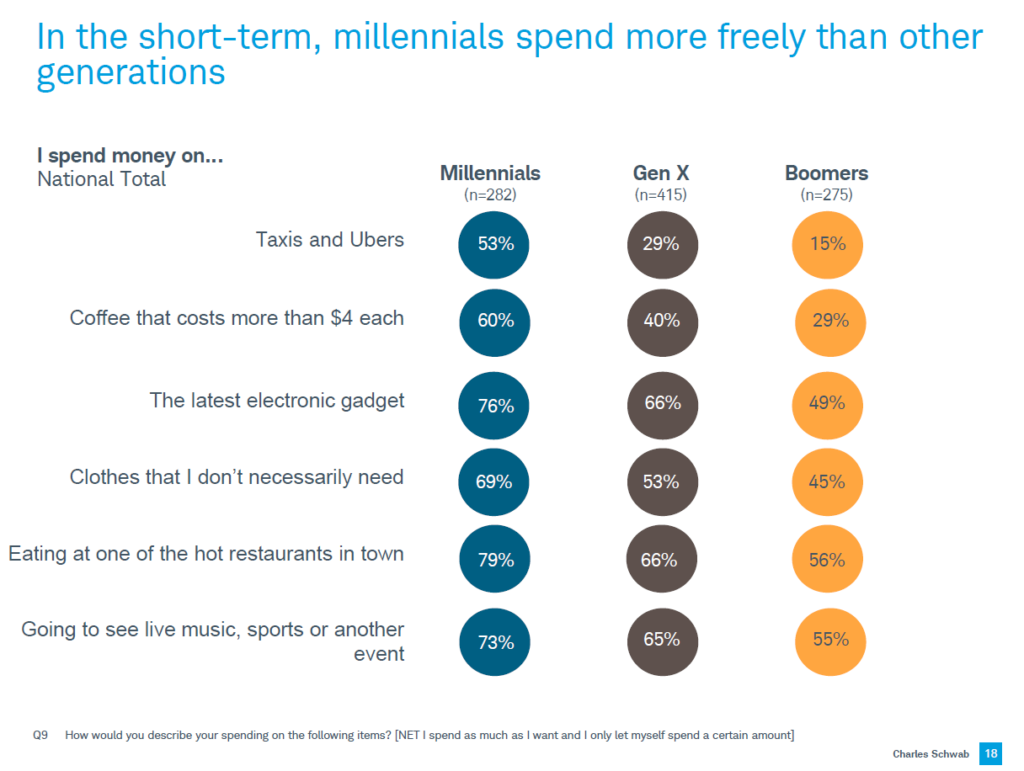

Alright, be honest with yourself. Take a look at this Charles Schwab survey:

*Image source

Now, you know there’s a difference between happiness and contentment, right? Happiness is the short-lived “high” that you get when something good happens (and that disappears the instant something bad happens). Contentment is a longer-lasting, deeper feeling—a sense of gratitude and appreciation for your life.

Got it? Okay, good. Now, take another look at that spending chart. Could you be just as content if you were drinking a $2 coffee each day? Could you be just as content if you wore clothes and used phones and electronics for longer before replacing them? Could you be just as content if you went to fewer live events and ate at home more often?

Good. Now you can pay off your debt more quickly. And you can learn how to brew your own coffee.

2. You’re already saving—save more

Embrace saving as a lifestyle choice. This will be the most significant decision that you make (after paying off those debts). Prioritizing saving will encourage you to find even more ways to live comfortably—and to be perfectly content—with less.

Baby boomers are not good role models for this, I realize, but there are lots of others out there who are:

People living in Sweden, Switzerland, Germany, Belgium, France and China save, on average, at least 10% of their annual income every year.

Closer to home, there’s the Silent Generation (people born in the mid-1920s through the early 1940s—during the Great Depression and World War II). They worked hard at whatever job they could find, made possessions last as long as possible and saved every spare penny—and it paid off. They ended up being the wealthiest generation ever—and, ultimately, they drove much of the post-World War II economic boom.

Money isn’t happiness, but it is security—if you make saving a priority, then temporary setbacks (like a sudden job loss) won’t bankrupt you.

3. You’re already sharing—share more

Bikes, cars, public transit, thrift shops…you’re finding a lot of ways to get what you need—and to get where you need to go—without spending a ton of money.

But you can’t afford to buy a home and have a family, right? Are you sure? The obvious suggestion would be to buy something far smaller and cheaper than your parents did—and to look into alternative child care arrangements, like nanny shares. Those are great ideas, but there are other options, too:

Millennials are now part of a new housing trend—shared housing. In the last 20 years, there’s been a 37% increase in the number of people sharing households—along with chores, meal prep, living expenses and, yes, even childcare. Many of these people are creating multigenerational homes. In some Canadian communities—like Brampton, Markham and Scarborough, Ontario, and Surrey, B.C.—20% of residents now live in multigenerational homes.

And relatives and friends aren’t your only options for shared housing. There are over 1,500 cohousing communities across the U.S., 35 in Canada and over 700 in Denmark and Sweden. Specialized options are even popping up—CoAbode helps single moms wanting to live and raise their kids together in the U.S.

Look, you’re an educated, adaptable, inventive generation—and you’re the largest generation alive right now, so you have the power to make change (for yourself, and for others).

Challenge yourself to spend as little as possible so you can prioritize debt repayment and savings. Use contentment as your guide so you can wean out unnecessary expenses. Use that wild imagination of yours to find ways to share resources—including housing and daycare—so you can support each other and succeed at your biggest life goals.

Financially, you got a raw deal when you graduated—but you can turn this around. And you can make your own damned coffee.

I have to give my son credit. He didn’t know what he wanted to study in college, so he went to our local community college. No way were we able to afford what my neighbors did. My neighbor has 3 kids. Kid #1 went to a university in Virginia (we’re in NJ) for one semester and decided he didn’t like it. They were out at least $10k for that. Went to community college and then the local university. Kid#2 went 4 years to Gettysburg College, at $60k A YEAR. Kid#3 went to Boston College. She’s been there 5 years and lives off campus at the cost of $2k a month for rent. Add them all up, that family is in debt upwards of $700k. Yeah. My son, who was snickered at for going to community college and driving mom’s 1989 Volvo, graduated with an Associate’s Degree, is working 2 jobs while living at home, has paid off his student loan and has more $$ in the bank than I do. Compared to the neighbors who were doing the snickering, he looks like a damned genius.

Sandy, what a great story – congratulations on raising such a well-grounded kid 🙂

Things get even MORE complicated when you are a disabled Millennial. You have all the general problems, plus limited income options because of health issues.

I live with family, get most of nice clothes as ‘rich friend hand-me-down,’ and haven’t upgraded my computer, phone, or gaming system in years. (My kid brother makes a mean coffee.) What do I do with the saved money? Buy quality groceries so my body runs better 😉

So far, I live check-to-check. But have NO credit card, student, or medical debts. The next step is make plans for if/when SSDI benefits are cut. Creativity is a must. I don’t want to pull a Walter White XD

Sounds like you’re doing a fantastic job of managing a difficult situation, Loren – kudos!

Brenda:

Just an excellent detailed summary of advice for many students and recent students who are finding it difficult to manage their affairs.

I congratulate you on the sound advice you are offering.

Keep up the good work.

Arnold

Thank you so much, Mr. Forsyth – I’m really glad you read my blog 🙂

Isn’t it fun to give this generation advice? Haha. I wrote a post of advice from a Gen Xer.

This generation sure gets lots of attention. Of course, it’s us who gives it to them!

Glad I finally read a post here. I’ve been getting your newsletters. Awesome stuff here, Brenda. I’ll definitely be back.

Thank you, Eli! Those maple bacon scones on your Twitter page look yum (that’s off-topic, but I’m hungry 🙂

Brenda